Reliable Powerful and Flexible Raw Spreads from 0.0 pips

PARTNER WITH BEST FOREX BROKER

Earn unlimited commissions and build your own affiliate business as one of our partners!

Achieve your goals with exceptional support and marketing tools.

Benefit from Forex Market potential and our unique Partnership programs

Enjoy high commissions and continuous support to grow your business

best patekphilippe on the for the consistent expansion.

COPY TRADES WITH XTREME MARKETS

Most Convenient

and Simplest Way to Trade Forex

Xtreme Markets Copy Trading Program offers the opportunity to automatically copy trades of successful traders so that you do not have to spend many hours developing your own strategy. Join the Copy Trading program now and let the selected professionals work for you!

Security of Funds

Risk

Management

Leading

Financial Safety

Accounts with

major banks

Segregated

Accounts

Negative Balance

Protection

TRADING ACCOUNT TYPES

TRADING ACCOUNT TYPES

MARKET ANALYSIS & EDUCATION

Beginner Course

Learn all the basic concept of Forex Trading and step up your trading career with XtreamForex Beginners Course.

Show Latest News

GBP/USD Stays Above 1.2500 Ahead of Tuesday’s UK Labor Data During Monday’s Asian trading session, the GBP/USD...

Risk Management

Learn all the strategies and Tips of Risk Management that you need to power up your Trading Career.

Show Latest News

Latest Webinar

Risk Management

Beginner Course

OUR AWARDS

Best Customer

Support Broker

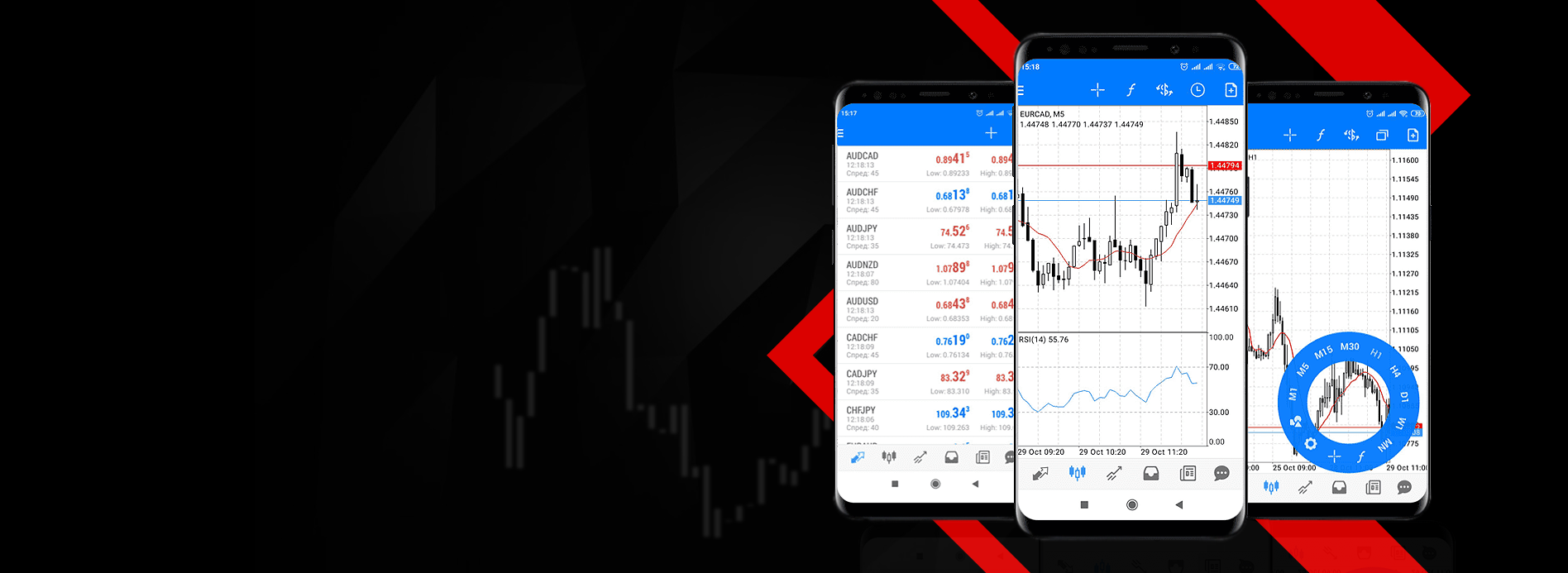

Best

MT4 & MT5

Best Affiliate

Program

Best Customer

Support Broker

Best Forex Broker

Asia & Europe

Best Global

Forex Broker

Best Online

Broker in Asia

Best Client

Experience Broker

Most Popular

Forex Broker

.webp)